Using Trust For Real Estate Investment

Why a Family Trust for Property Investment

Investing in property through a family trust has gained popularity as a strategic way to secure tax advantages and protect assets. Many clients exploring investment structures often consider family trusts as a viable option. However, understanding the role of a family trust in property investment is crucial before making any decisions.

If you’re contemplating using a family trust to purchase your next property, here’s a comprehensive guide to help you make an informed decision.

What Is a Trust?

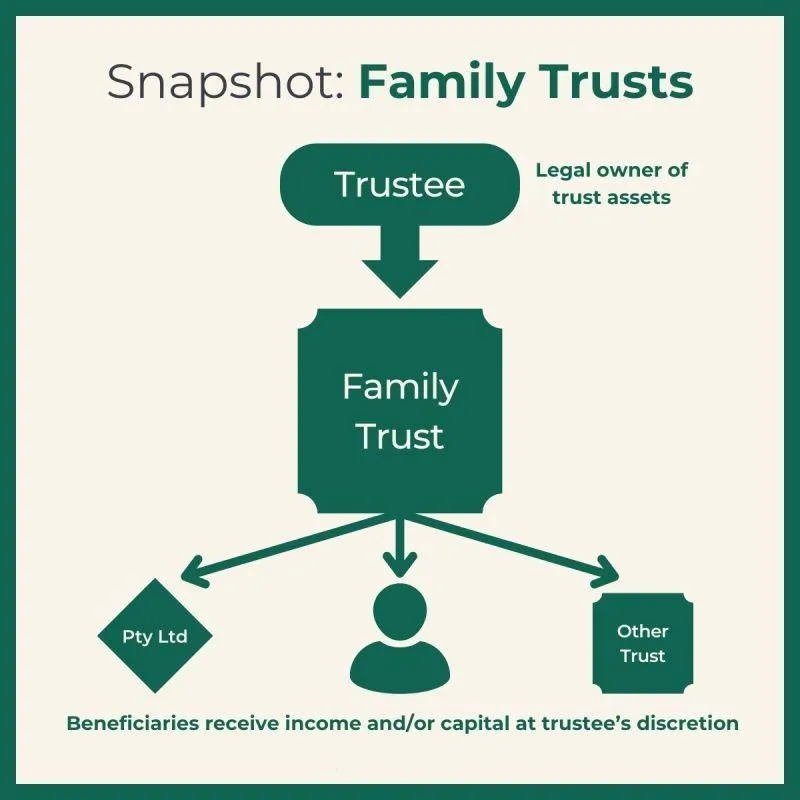

A trust is a legal relationship between a trustee and beneficiaries, as defined by the Australian Tax Office (ATO). The trustee holds and manages assets on behalf of the beneficiaries. Unlike individuals or companies, a trust is not a separate legal entity. Instead, it represents the relationship between the trustee (legal owner) and the beneficiaries (beneficial owners). Assets in a trust are held in the trustee’s name.

Types of Trusts

There are three common trust structures:

1. Discretionary Trusts (Family Trusts): The trustee has flexibility in distributing income and capital to beneficiaries.

2. Fixed Trusts: Beneficiaries’ entitlements are fixed, leaving no discretion to the trustee.

3. Hybrid Trusts: Combines features of discretionary and fixed trusts, with varying entitlements for different beneficiaries.

Among these, family trusts are the most popular choice for property investors.

What Is a Family Trust?

A family trust is a discretionary trust designed to manage family assets or businesses. The trustee has full discretion over how income and capital are distributed among beneficiaries.

Using a Family Trust for Property Investment

When you purchase an investment property through a family trust, the trustee (an individual or company) becomes the legal owner, while you are the beneficial owner. This separation offers several advantages:

1. Asset Protection: The property is shielded from creditors if a beneficiary faces bankruptcy or legal action.

2. Tax Planning: The trustee can distribute income to beneficiaries in a tax-efficient manner, potentially reducing overall tax liabilities.

3. Estate Planning: The trust deed outlines how assets are managed and transferred, simplifying succession and avoiding disputes.

Benefits of a Family Trust for Property Investment

1. Asset Protection

The trust legally owns the property, which can help protect assets from creditors or lawsuits against individual beneficiaries.

If a beneficiary is in financial trouble, their creditors generally cannot access trust assets.

2. Tax Planning & Income Distribution

The trust can distribute rental income and capital gains to beneficiaries in a tax-effective manner.

Beneficiaries with lower tax rates (e.g., a spouse or adult children) can receive more income, reducing the overall tax paid.

3. Capital Gains Tax (CGT Discount)

If the trust holds the property for more than 12 months, it qualifies for the 50% CGT discount, just like an individual investor.

3. Estate Planning & Succession

A discretionary trust allows for flexible succession planning without triggering CGT or stamp duty.

Instead of transferring the property, you change control of the trust, which avoids probate and inheritance issues.

4. Borrowing

If the family trust is self sufficient, the trust does not affect your borrowing capacity ( some of the lenders are pro trust borrowing), which can help you build property portfolio.

Key Considerations When Using a Family Trust

1. Retirement Planning: Ensure your investment structure supports your desired lifestyle post-retirement.

2. Family Succession: Structure the trust to facilitate smooth asset transfer to heirs without excessive tax or legal complications.

3. Costs: Setting up and maintaining a family trust can be expensive. Weigh the benefits against the costs to ensure it’s a worthwhile investment.

---

Potential Risks of Using a Family Trust

1. Negative Gearing Limitations

If your investment property is negatively geared, losses cannot be offset against your personal income. Instead, losses remain within the trust until it generates sufficient income to cover them.

2. Land Tax Implications

In some states, such as New South Wales and Victoria, family trusts do not qualify for the land tax-free threshold, potentially leading to higher land tax payments.

3. Stamp Duty and Capital Gains Tax

Transferring an existing property into a family trust may attract stamp duty and capital gains tax, increasing the overall cost.

Key Takeaways

A family trust is a powerful tool for property investors, offering benefits like asset protection, tax efficiency, and streamlined estate planning. However, it’s not without risks, such as limitations on negative gearing and potential land tax liabilities.

Since every investor’s situation is unique, there’s no “one-size-fits-all” solution. Consulting a tax specialist or financial advisor is essential to determine if a family trust aligns with your investment goals.

At Sydney Tax & Accountancy Services, we specialize in helping property investors maximize opportunities, protect assets, and minimize tax liabilities.

Contact us today to discuss how a family trust can work for you.